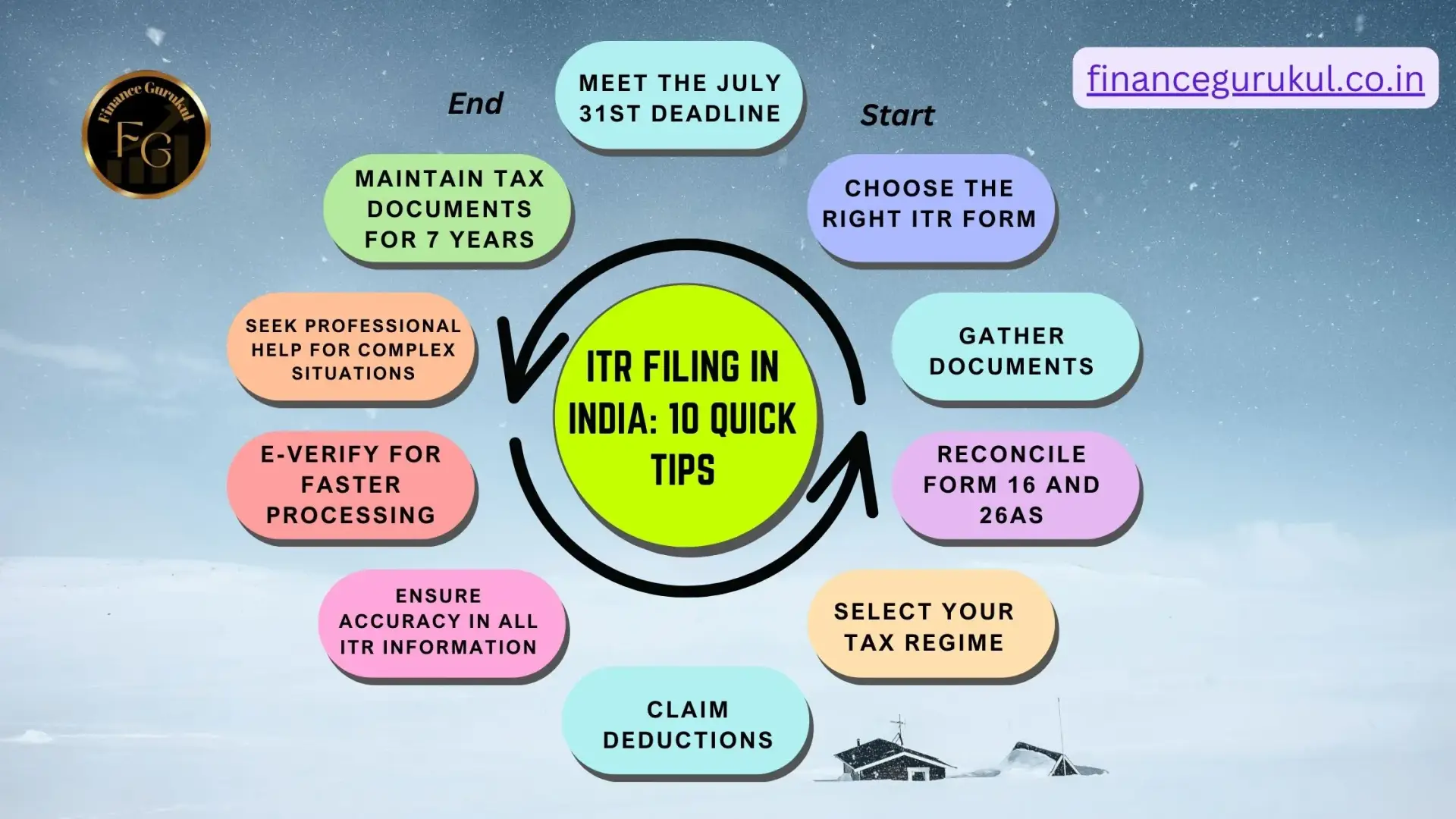

Filing your Income Tax Return (ITR) in India is a crucial annual responsibility. To ensure a smooth, accurate, and potentially tax-saving process, here are 10 essential points to keep in mind:

- Deadline Awareness: The due date for filing ITRs typically falls on July 31st of each assessment year. Penalties can be levied for late filing, so adhering to this deadline is vital. Missing the deadline can also lead to delays in claiming tax refunds and other benefits.

- Choosing the Right ITR Form: The Income Tax Department offers various ITR forms catering to different income categories and taxpayer profiles. Carefully identify the form applicable to your situation. Common forms include ITR-1 (Sahaj) for salaried individuals with basic income, ITR-2 for individuals with income from capital gains or business, and ITR-3 for business owners and professionals. Choosing the wrong form can lead to processing delays or even rejection of your return.

- Gather Necessary Documents: Collect all relevant documents beforehand to avoid delays. These typically include Form 16 (from your employer), Form 16A (for income from other sources), Form 26AS (a consolidated tax statement), bank statements, investment proofs, and receipts for eligible deductions. Having everything organized beforehand will streamline the filing process.

- Reconcile Form 16 and Form 26AS: Cross-check the details mentioned in your Form 16 (TDS certificate) with those reflected in Form 26AS. Any discrepancies, such as variations in tax deducted at source (TDS) amounts, should be reported to your employer or the concerned deductors for rectification. Unreported income or mismatched TDS details can flag your return for scrutiny by the tax department.

- Understanding Tax Regimes: India offers two tax regimes: the old regime with various deductions and exemptions, and the new regime with lower tax rates. Evaluate which regime offers you a better tax benefit based on your income and deductions. Carefully consider factors like the deductions you are eligible for, your investment plans, and the tax slabs under each regime before making a choice.

- Maximizing Deductions: Take advantage of all eligible deductions to minimize your tax liability. Common deductions include those for House Rent Allowance (HRA), medical insurance premiums, investments in Public Provident Fund (PPF), Employee Provident Fund (EPF), and National Pension System (NPS), and interest repayments on home loans. Remember to maintain proper documentation for all claimed deductions, as they may be required for verification by the tax authorities.

- Accuracy and Transparency: Ensure all information provided in your ITR is accurate and complete. Discrepancies or missing information can lead to scrutiny by the tax department, potentially resulting in delays, penalties, or even tax assessments.

- E-verification is Key: After filing your ITR online, e-verify your return using a digital signature certificate or by generating an e-verification code and getting it physically verified at a bank branch authorized for this purpose. E-verification expedites processing and reduces the chances of your return being selected for scrutiny.

- Seeking Professional Help: For individuals with complex tax situations, involving business income, foreign assets, or capital gains, consulting a registered tax advisor or chartered accountant can be beneficial. They can guide you through the intricacies of the ITR filing process, ensure compliance with tax regulations, and help you optimize your tax liability by identifying all applicable deductions and exemptions.

- Record Keeping: Maintain a proper filing system for all your tax-related documents for at least seven years. This will be helpful in case of any inquiries from the tax department or if you need to file revised ITRs in the future. Proper record keeping can save you time and hassle in the long run.

By following these ten crucial points, you can ensure a smooth, accurate, and potentially tax-saving ITR filing experience in India. Remember, timely filing, accurate reporting, and proper record-keeping are essential for responsible tax compliance.