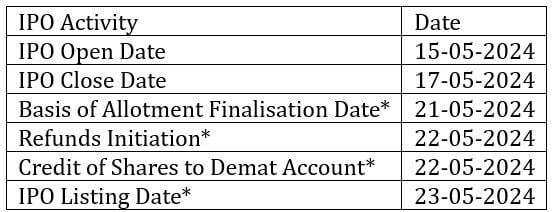

Go Digit General Insurance IPO has opened for subscription today (Wednesday, May 15), and will close on Friday, May 17. Go Digit IPO opens for subscription with a price band of ₹258 to ₹272 per equity share. Go Digit General Insurance IPO includes an offer-for-sale of 54,766,392 equity shares and a fresh issue of ₹1,125 crore

Approximately 75% of the issue size has been allocated for qualified institutional investors, 15% for non-institutional investors, and the remaining 10% for retail investors. Investors may bid for a minimum of 55 equity shares and multiples of 55 equity shares thereafter.

The quota for Retail Individual Investors (RIIs) received 1.44 times subscription while Non-Institutional Investors (NIIS) category got subscribed 34%. The portion for Qualified Institutional Buyers (QIBs) is yet to be booked.

The issue’s price band is fixed at ₹258 to ₹272 per equity share having a face value of ₹10. The lot size for the IPO is 55 equity shares, with subsequent multiples of 55 equity shares

IPO GMP

As per Investorgain Go Digit General Insurance IPO last GMP is ₹35, last updated May 15th, 2024, 08:01 PM. With the price band of 272.00, Go Digit General Insurance IPO’s estimated listing price is ₹290 (cap price + today’s GMP). The expected percentage gain/loss per share is 6.62%. of ₹1,125 crore.

About Go Digit

Go Digit General Insurance Ltd, backed by Canada’s Fairfax Group, raised a little more than ₹1,176 crore from anchor investors. According to a circular posted late Tuesday, the business has allocated 4.32 crore equity shares to 56 funds at ₹272 each, at the upper end of the price band. The firm’s investors include cricketer Virat Kohli, his wife, and actress Anushka Sharma. They are not selling any shares in the IPO.

Go Digit provides car insurance, health insurance, travel insurance, property insurance, marine insurance, liability insurance, and other insurance products to satisfy the demands of its clients.

It is one of India’s first non-life insurers to operate entirely on the cloud, and it has created application programming interface (API) linkages with a number of channel partners.

Disclaimer: Finance Gurukul provides stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.