The implementation of India’s new Labour Codes mandates that Basic Salary must be 50% of the CTC. Find out the exact impact on your take-home pay, how your Gratuity is set to increase, and what employees need to do now.

Table of Contents

A quick roadmap to understanding the changes in your salary structure and benefits.

Introduction: The End of Allowance-Heavy Salaries

- The Historical Low-Basic Pay Loophole

- The Reason for Mandatory Restructuring

1. The Core Change: The Mandatory 50% ‘Wages’ Rule

- The New ‘Wages’ Definition

- The 50% Threshold Rule (Cap on Allowances)

- The Add-Back Mechanism

2. Impact on Basic Pay and Take-Home Salary 💸

- 📉 Lower In-Hand Salary (Short-Term Effect)

- Understanding the PF Deduction Increase

- Comparison: Old vs. New Salary Structure (Chart Analysis)

3. Impact on Gratuity Payouts (Long-Term Benefit) 💰

- A. Higher Gratuity Calculation Base

- The New Gratuity Formula and Calculation Base

- Example: Gratuity Payout Comparison

- B. Major Benefit for Fixed-Term Employees (FTEs)

- FTE Gratuity Eligibility: From 5 Years to 1 Year

What Employees Must Do Now (Action Plan)

- Review Your Pay Structure

- Adjust Your Budget (Embrace Compulsory Savings)

- Validate Gratuity Eligibility

Conclusion: Securing Your Financial Future

Also Read: Unlocking Safe Investments with High Returns in India (2025 Guide)

Introduction: The End of Allowance-Heavy Salaries

The implementation of India’s four new Labour Codes, effective from November 21, 2025, marks the biggest overhaul of salary structure in decades, primarily due to the uniform definition of ‘Wages’ and the subsequent impact on statutory benefits like Provident Fund (PF) and Gratuity

Historically, many companies intentionally kept the Basic Salary low (sometimes 25% to 40% of the Cost-to-Company or CTC) while padding the rest of the package with high allowances (HRA, Special Allowance, Conveyance, etc.). This tactic was used to reduce the employer’s mandatory contribution towards statutory benefits like Provident Fund (PF) and Gratuity, as these are primarily calculated based on the Basic Salary and Dearness Allowance (DA).

The new labour codes shut this loophole, leading to a major salary restructuring that means less take-home pay now, but more security for your retirement.

The Core Change: The 50% Rule for Basic Pay

The most significant provision is found in the Code on Wages, 2019, which introduces a comprehensive definition of “Wages” that affects all statutory calculations. The fundamental principle introduced by the Code on Wages is the 50% Threshold for Non-Allowances.

The 50% Threshold Rule

The new Labour codes effectively mandate that the statutory “Wages” component must be at least 50% of an employee’s total remuneration (Cost-to-Company or CTC).

- Wages Defined: For statutory calculation purposes, ‘Wages’ primarily include Basic Pay, Dearness Allowance (DA), and Retaining Allowance (if any).

- The Cap on Allowances: The rule states that the sum of all excluded allowances (like HRA, conveyance, special allowance, etc.) cannot exceed 50% of the CTC.

- The Add-Back Mechanism: If a company’s salary structure keeps the total allowances above the 50% threshold, the excess amount must be added back to the ‘Wages’ component. This artificially increases the base upon which PF and Gratuity are calculated, ensuring the employer cannot bypass the spirit of the law.

In simple terms, most companies are now mandatorily required to increase the Basic Pay component to 50% of the CTC to comply efficiently.

In effect, this mandates that the “Wages” component (Basic Pay + DA + Retaining Allowance) must be at least 50% of the total CTC. Companies whose salary structures failed to meet this 50% threshold are now forced to restructure and increase the Basic Pay component.

Impact on Basic Pay and Take-Home Salary 💸

The increase in the Basic Pay component directly affects your monthly cash flow because mandatory deductions are calculated on this higher base.

Lower In-Hand Salary (Short-Term Effect)

Since Provident Fund (PF) is calculated as 12% of Basic Pay (or Wages), raising the Basic Pay component within the same CTC figure automatically increases the PF deduction. To keep the total CTC the same, the employer must reduce other allowances (like Special Allowance or HRA), which are paid out in cash.

The net effect is: Same CTC, but less monthly take-home cash as a larger portion is diverted into compulsory, long-term savings.

| Particulars | Old Structure (Basic 30% of CTC) | New Structure (Basic 50% of CTC) | Impact |

| Annual CTC | ₹10,00,000 | ₹10,00,000 | No Change |

| Basic Pay + DA | ₹3,00,000 (30%) | ₹5,00,000 (50%) | ↑ Higher |

| Allowances (HRA, Special, etc.) | ₹7,00,000 (70%) | ₹5,00,000 (50%) | ↓ Lower |

| Employee PF Contribution (12% of Basic) | ₹36,000 | ₹60,000 | ↑ Higher |

| Monthly Take-Home Pay (Approx.) | ₹67,000 | ₹62,000 | ↓ Lower |

This comparison clearly shows the trade-off: The total CTC remains the same, but the increase in the mandatory Basic component directly leads to a higher PF deduction, resulting in a lower monthly in-hand salary.

Impact on Gratuity Payouts (Long-Term Benefit) 💰

The new labour codes provide a substantial long-term benefit by ensuring a much higher Gratuity payout upon separation.

Higher Gratuity Calculation Base

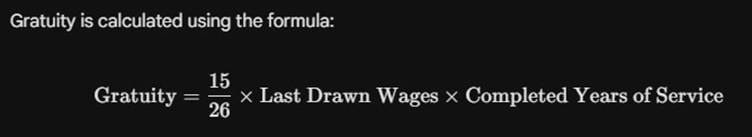

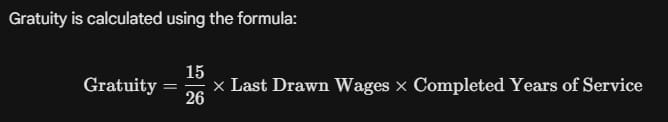

Gratuity is calculated using the formula:

Under the new labour codes law, the “Last Drawn Wages” used in this formula is the higher figure mandated by the 50% rule. Since your Basic Pay component is now significantly higher, the base for your Gratuity calculation increases correspondingly, leading to a much larger lump-sum payout upon leaving the company (after five years of service for permanent employees).

- Example: For an employee with a ₹10 Lakh CTC and 10 years of service, the Gratuity payout could increase by 50% to 70% compared to the old structure where the basic was low.

Under the new labour codes, the definition of “Last Drawn Wages” is what changes the game:

1. Higher Gratuity Base: Since Basic Pay (which forms the core of “Wages”) must now be at least 50% of the CTC, the Gratuity calculation base has effectively increased for a vast majority of employees whose Basic Pay was previously low.

2. Inclusion of Excess Allowances: Even if an employer tries to avoid increasing the Basic Pay, the mandatory add-back of excess allowances (over 50% of CTC) into the ‘Wages’ component ensures the Gratuity calculation is performed on a higher, more realistic base.

In this typical example, the Gratuity payout increases by approximately 66%, providing a much stronger financial cushion upon separation.

Major Benefit for Fixed-Term Employees

The Labour Code on Social Security, 2020, introduces a landmark change for Fixed-Term Employees (FTEs):

Old Rule: Gratuity was only payable to permanent employees or FTEs after completing five years of continuous service.

New Rule: Fixed-Term Employees are now eligible for pro-rata gratuity after completing just one year of continuous service. They are also entitled to all statutory benefits (PF, ESIC, etc.) on par with permanent employees.

| Scenario | Gratuity Calculation Base (Wages) | Calculation | Estimated Gratuity Payout |

| Old Law (Basic was 30% of CTC) | Monthly Basic + DA: ₹25,000 | 2615×25,000×10 | ₹1,44,230 |

| New Labour Codes (Basic must be 50% of CTC) | Monthly Basic + DA: ₹41,667 | 2615×41,667×10 | ₹2,40,385 |

This change extends a critical social security benefit to a growing segment of India’s workforce, providing stability and compensation for their contributions.

What Employees Must Do Now

1. Review Your Pay Structure: When your employer implements the new structure, ensure your Basic Pay + DA is genuinely 50% or more of your CTC. If it’s not, and the allowances exceed 50%, the employer must ensure the statutory contributions (PF and Gratuity base) are calculated on the higher, mandated “Wages” value.

2. Adjust Your Budget: Prepare for a slight reduction in your monthly take-home salary due to increased mandatory PF contribution. Treat this reduction not as a loss, but as enhanced, tax-efficient, compulsory retirement savings.

3. Validate Gratuity: Understand that your higher Gratuity liability will only be fully realized upon your exit (after 5 years for permanent employees, or 1 year for FTEs).

Conclusion: The new Labour Codes represent a significant step toward improving social security and formalizing the Indian workforce. While the immediate effect may be a lower monthly paycheck, the long-term rewards—a substantially higher Gratuity and a robust Provident Fund corpus—cement a more secure financial future for employees.

Must Read : Smart Money Management: Investing, Expense Tracking, and Financial Goals

Frequently Asked Questions (FAQs)

General Impact & Salary Structure

Q1: Is it mandatory for my Basic Salary to be exactly 50% of my CTC now?

A: Not precisely. The New labour codes law states that the total sum of allowances (components excluded from the statutory wage base, like HRA, conveyance, special allowance) cannot exceed 50% of your total remuneration (CTC). If allowances exceed 50%, the excess amount must be added back to the ‘Wages’ component for calculating PF and Gratuity. In practice, this forces companies to set Basic Pay + DA at 50% or more of the CTC to remain compliant and avoid complex add-back calculations.

Q2: Why will my monthly take-home salary decrease if my CTC remains the same?

A: Your take-home salary decreases because your Basic Pay is increasing to meet the mandatory 50% threshold. Since mandatory contributions like Provident Fund (PF) (12% employee contribution) are calculated on this higher Basic Pay, the amount deducted from your salary for PF goes up. To keep your overall CTC the same, non-statutory allowances (which were previously paid out in cash) must be reduced to offset the higher PF deduction.

Q3: Does the new 50% rule apply to Gross Salary or CTC?

A: The 50% rule is checked against your total remuneration for the wage period, which is essentially your CTC excluding the employer’s contributions to PF and Gratuity. The test applies to all payments made to the employee (Basic, DA, HRA, special allowances, etc.).

Q4: When do these new Labour Code rules become effective?

A: The new Labour Codes, consolidating 29 old laws, are effective from November 21, 2025. All employers must restructure their salary components and compliance mechanisms from this date.

Gratuity and Retirement Benefits

Q5: Is the Gratuity calculation formula changing under the new codes?

A: No, the fundamental Gratuity formula remains the same:

However, the crucial change is that the term “Last Drawn Wages” used in the formula will now be the higher figure mandated by the 50% rule, leading to a significantly higher Gratuity payout for most employees.

Q6: Do permanent employees now get Gratuity after just 1 year of service?

A: No. The standard Gratuity eligibility rule for Permanent Employees remains 5 years of continuous service. The reduction in eligibility to 1 year of continuous service applies specifically to Fixed-Term Employees (FTEs) and certain contract workers.

Q7: Will my Provident Fund (PF) balance increase faster now?

A: Yes. Since your Basic Pay (the base for PF contribution) must be at least 50% of your CTC, both your contribution (12%) and your employer’s contribution (12%) will be calculated on a higher base. This will accelerate the growth of your PF corpus, significantly strengthening your long-term retirement savings.

Q8: Is there a penalty if my employer delays Gratuity payment?

A: Yes. Under the new labour Code on Social Security, if an employer fails to release the Gratuity amount within 30 days of it becoming payable (e.g., termination or resignation date), they are liable to pay a penalty, typically 10% annual interest on the outstanding amount until it is paid.

Actionable Steps

Q9: What should I check on my payslip after the new labour codes take effect?

A: You must check two things:

- Basic Pay + DA: Ensure this total constitutes at least 50% of your CTC.

- PF Deduction: Ensure the PF contribution (12% of your salary) is calculated on this new, higher Basic Pay figure, confirming your employer is compliant.

Q10: How should I adjust my monthly budget for this change?

A: Budget for a small reduction in your monthly in-hand cash due to the increased PF deduction. It is advisable to review your monthly expenses and EMIs to ensure you can comfortably absorb the slight dip in take-home pay, viewing the difference as a necessary and beneficial increase in your long-term savings.