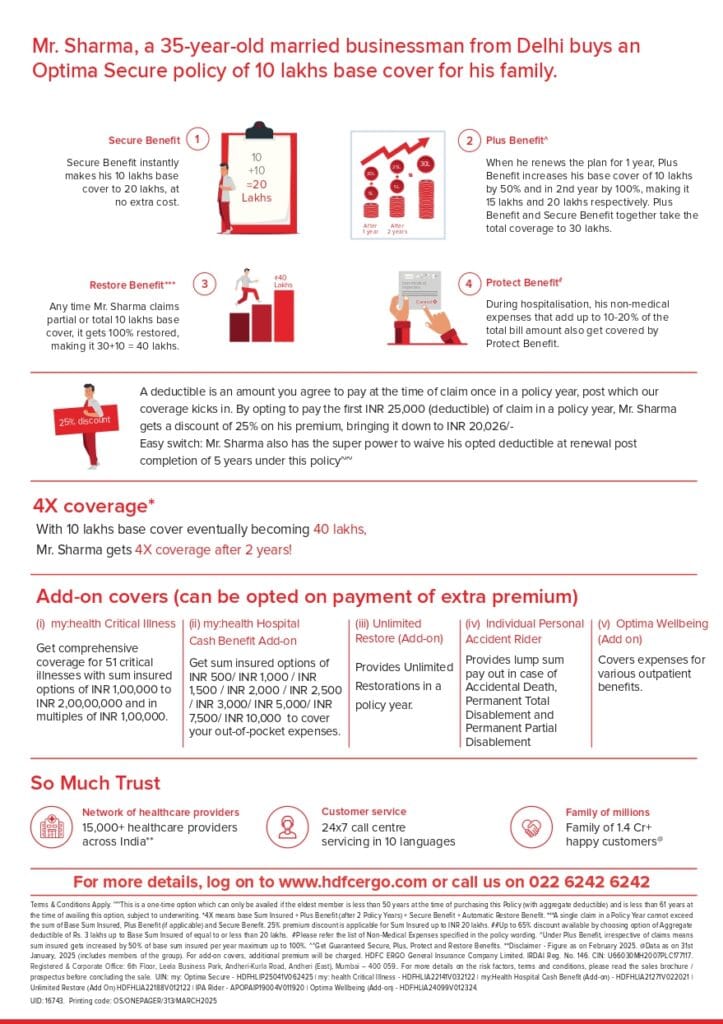

HDFC ERGO Health Insurance

Why Health Insurance is Important

Health insurance is an indispensable financial shield, vital for safeguarding your well-being and assets in an unpredictable world.

Firstly, it provides crucial financial protection against the ever-rising cost of medical care. A sudden illness, accident, or chronic condition can lead to exorbitant hospital bills, diagnostic tests, and specialist fees. Without insurance, these expenses could quickly deplete your savings, force you into debt, or compel you to compromise on the quality of treatment. Health insurance ensures you can access necessary, high-quality care without the immediate fear of financial ruin.

Secondly, it guarantees access to quality healthcare. Insurance plans typically offer a network of reputable hospitals and doctors, often including cashless treatment facilities. This access is critical during emergencies, ensuring timely and specialized medical attention, which can be the difference between a full recovery and a devastating outcome.

Finally, health insurance offers invaluable peace of mind and allows for proactive health management. Knowing that your and your family’s health is protected provides significant emotional security. Furthermore, many policies cover preventive services like annual health check-ups. These regular screenings allow for the early detection of potential health issues, making treatment more effective and less costly in the long run.

In essence, paying a manageable premium today is an investment that protects your tomorrow, shielding your financial future from the inevitable and unpredictable costs of healthcare.

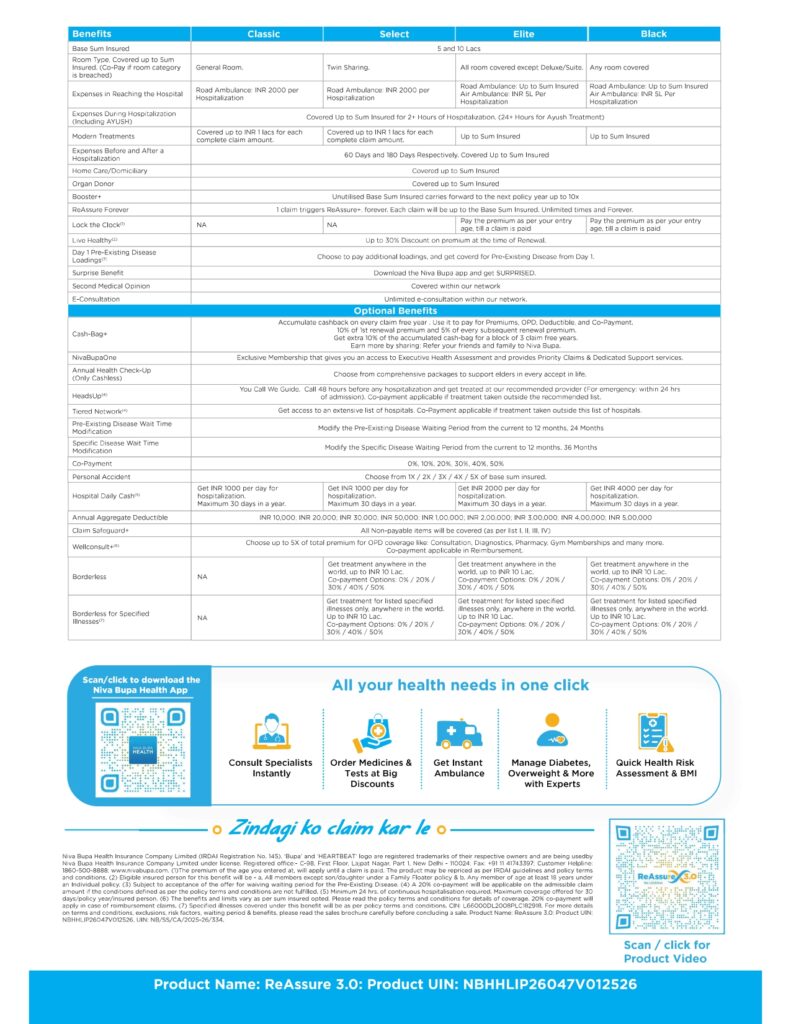

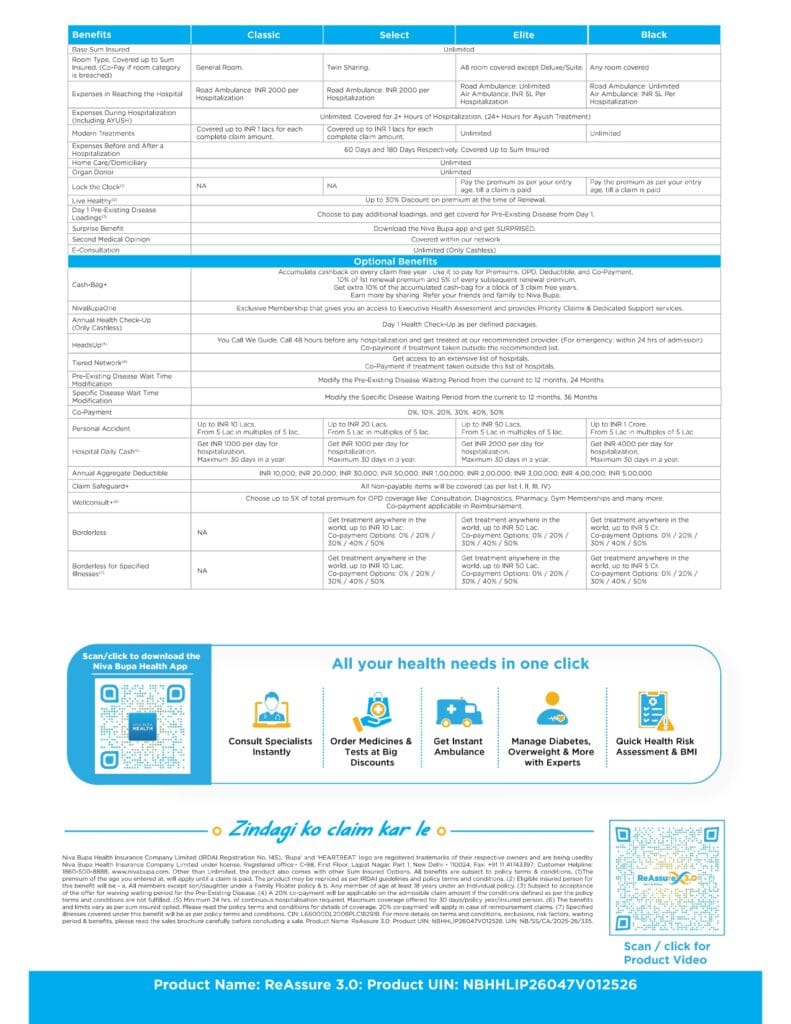

NIVA BUPA Health Insurance (ReAssure 3.0)

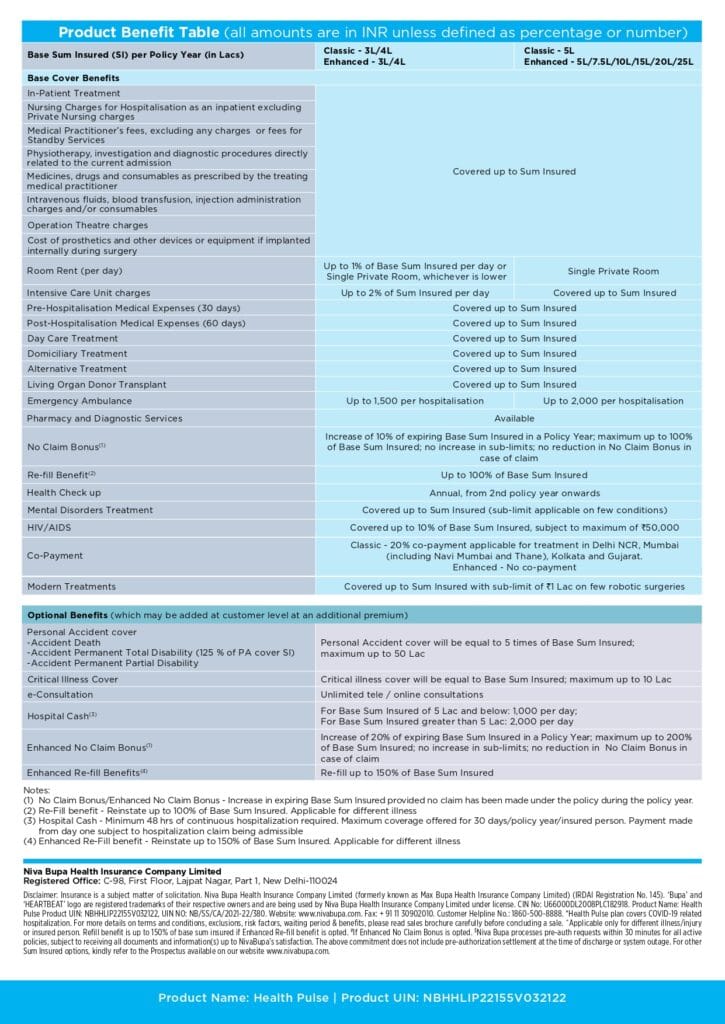

NIVA BUPA Health Insurance (Health Plus)

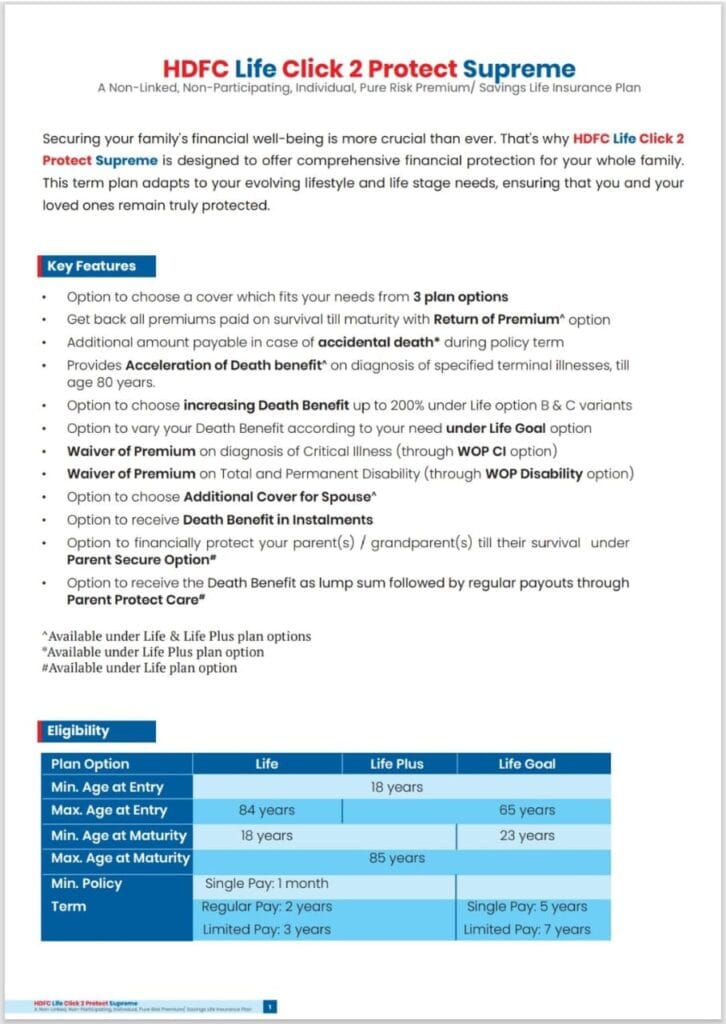

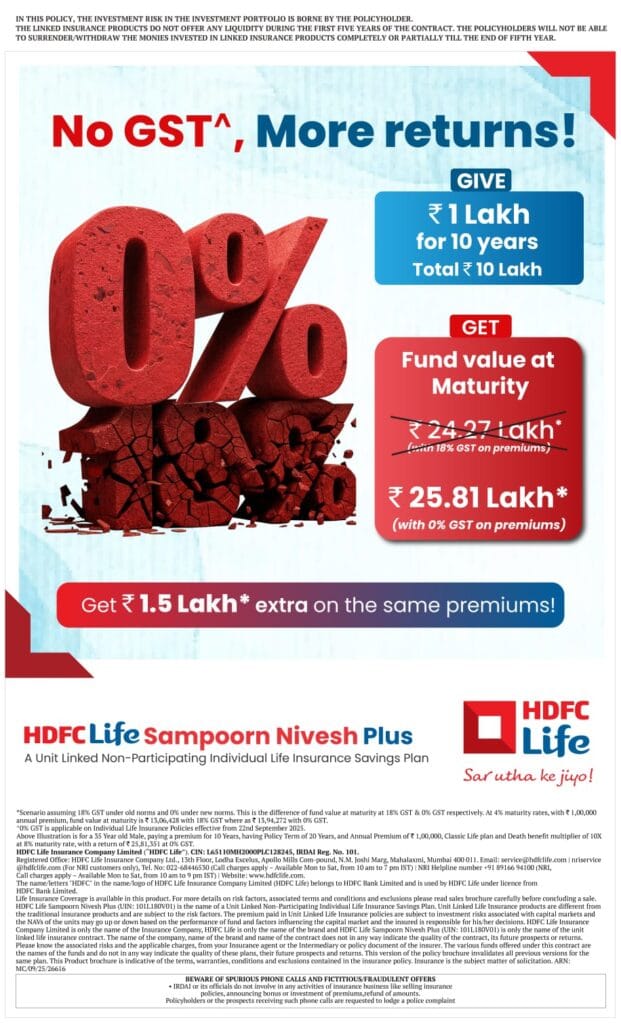

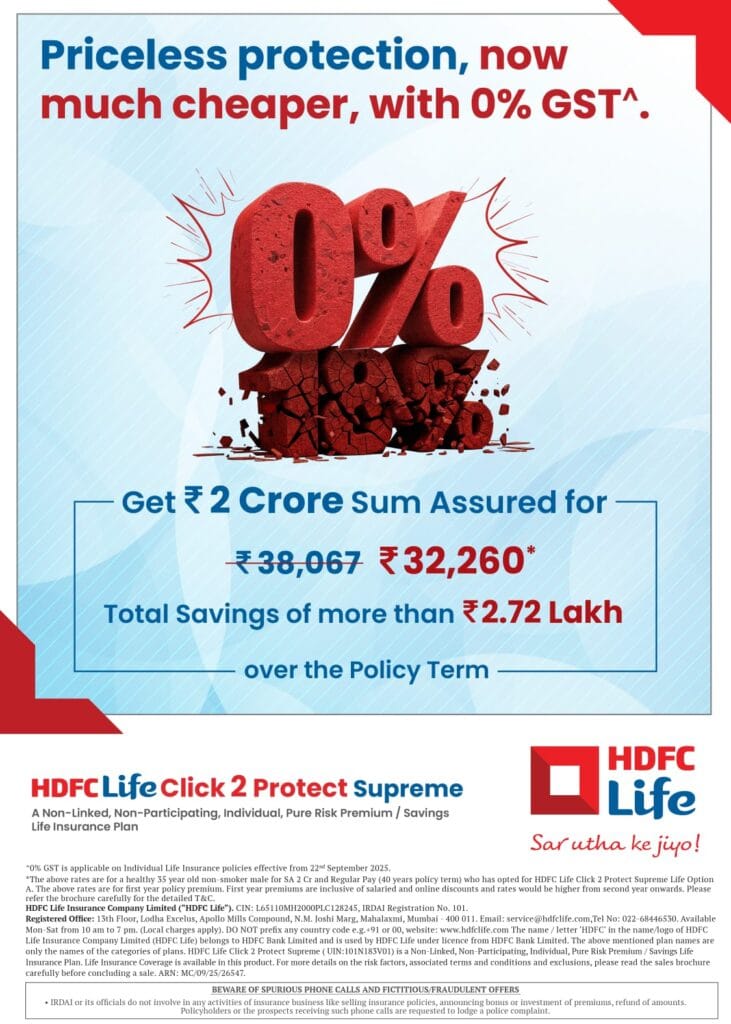

HDFC Life Insurance

Why Life Insurance is Important

Life insurance is a foundational element of financial security, primarily serving as a vital safety net for your loved ones. In the event of your unexpected passing, a policy pays a lump-sum, typically tax-free, death benefit to your named beneficiaries. This money is crucial for replacing your lost income, ensuring your family can maintain their current standard of living without facing immediate financial hardship.

The benefit can cover essential, long-term expenses like mortgage payments, daily living costs, and funding a child’s education. It also immediately relieves your family of financial burdens such as outstanding debts, including car loans or credit card balances, and substantial final expenses like funeral and medical costs.

Beyond immediate protection, some permanent life insurance policies include a cash value component that grows over time. This value can be accessed during your lifetime, offering a flexible source of funds for emergencies or to supplement retirement income.

Ultimately, life insurance offers invaluable peace of mind. By securing a policy, you are proactively protecting your family’s future, ensuring their financial stability, and leaving a responsible legacy, regardless of what tomorrow brings.

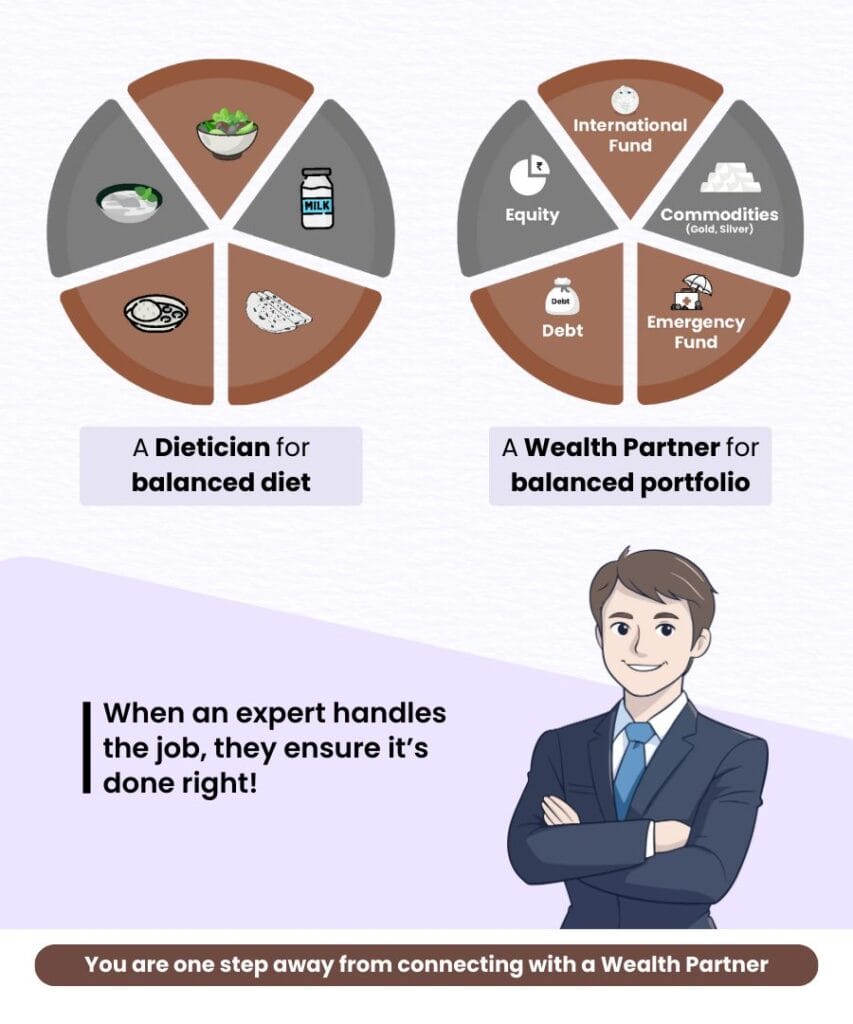

Mutual Fund and Stock Investment

Why Investment is Important

Investment is crucial for building long-term wealth and securing your financial future. While saving money is a necessary first step, simply keeping cash aside will often lead to a loss of purchasing power over time due to inflation. Investing allows your money to work for you, aiming for returns that not only counter inflation but actively grow your capital.

The most powerful benefit is the power of compounding. This is when the earnings from your investments are reinvested, generating their own returns. The earlier you start, the more time your money has to “snowball,” turning even small, regular contributions into a substantial corpus.

Beyond beating inflation, investing is the primary vehicle for achieving major financial goals, such as a comfortable retirement, funding a child’s education, or purchasing a home. It allows you to systematically accumulate assets that appreciate in value or provide a regular stream of income.

By strategically allocating capital across various assets like stocks, bonds, and real estate, you manage risk through diversification. In short, investing is essential for transitioning from a saver to a wealth builder, offering the potential for financial independence and peace of mind in your later years.