You get the strong reason to invest in Share market Part 1. So, I am writing the Second part of Share Market. After reading this article you should Understand the assets class, where to Invest. Read full article for Complete Knowledge. We want to make everyone financially literate and get early Retirement with financial freedom.

Demystifying the reason to invest the next obvious question would be – Where would one invest, and what are the returns one could expect by investing. When it comes to investing one has to choose an asset class that suits the individual’s risk and return temperament.

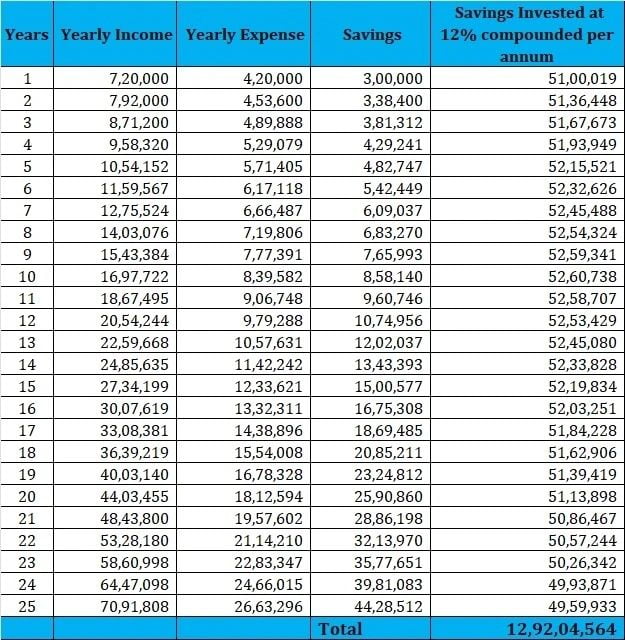

If you invest your Saved Cash at 12% per annum.

In 25 years, your Savings Should become 12.92 crs. So, I hope you get the reason again for making investment.

An asset class is a category of investment with particular risk and return characteristics. The following are some of the popular asset’s class…

1. Fixed income instruments

2. Equity

3. Real estate

4. Commodities (precious metals)

1. Fixed Income Instruments: These are investable instruments with very limited risk to the principle and the return is paid as an interest to the investor based on the particular fixed income instrument. The interest paid, could be quarterly, semi-annual or annual intervals. At the end of the term of deposit, (also known as maturity period) the capital is returned to the investor.

Typical fixed income investment includes:

a. Fixed deposits offered by banks

b. Bonds issued by the Government of India

c. Bonds issued by Government related agencies such as HUDCO, NHAI etc

d. Bonds issued by corporates

As of June 2014, the typical return from a fixed income instrument varies between 8% and 11%.

2. Equity: Investment in Equities involves buying shares of publicly listed companies. The shares are traded both on the Bombay Stock Exchange (BSE), and the National Stock Exchange (NSE). When an investor invests in equity, unlike a fixed income instrument there is no capital guarantee. However, as a trade-off, the returns from equity investment can be extremely attractive. Indian Equities have generated returns close to 14% – 15% CAGR (compound annual growth rate) over the past 15 years. Investing in some of the best and well-run Indian companies has yielded over 20% CAGR in the long term. Identifying such investments opportunities requires skill, hard work and patience. You may also be interested to know that the returns generated over a long-term period (above 365 days, also called long term capital gain) are completely exempted from personal income tax. This is an added attraction to investing in equities.

3. Real Estate: Real Estate investment involves transacting (buying and selling) commercial and non-commercial land. Typical examples would include transacting in sites, apartments and commercial buildings. There are two sources of income from real estate investments namely – Rental income, and Capital appreciation of the investment amount. The transaction procedure can be quite complex involving legal verification of documents. The cash outlay in real estate investment is usually quite large. There is no official metric to measure the returns generated by real estate, hence it would be hard to comment on this.

4. Commodity – Bullion: Investments in gold and silver are considered one of the most popular investment avenues. Gold and silver over a long-term period have appreciated in value. Investments in these metals have yielded a CAGR return of approximately 8% over the last 20 years. There are several ways to invest in gold and silver. One can choose to invest in the form of jewelry or Exchange Traded Funds (ETF). Going back to our initial example of investing the surplus cash it would be interesting to see how much one would have saved by the end of 25 years considering he has the option of investing in any one – fixed income, equity or bullion. By investing in fixed income at an average rate of 9% per annum, the corpus would have grown to Rs. 9.3 Crs.

So, here you found the Calculation.

1. By investing in fixed income at an average rate of 9% per annum, the corpus would have grown to Rs. 9.3 Crs.

2. Investing in equities at an average rate of 15% per annum, the corpus would have grown to Rs. 18.60 Crs.

3. Investing in bullion at an average rate of 8% per annum, the corpus would have grown to Rs.8.30 Crs.

Clearly, equities tend to give you the best returns especially when you have a multi – year investment perspective.

Important note on investments: Investments optimally should have a strong mix of all asset classes. It is smart to diversify your investment among the various asset classes. The technique of allocating money across assets classes is termed as ‘Asset Allocation’.

For instance, a young professional may be able take a higher amount of risk given his age and years of investment available to him. Typically, investor should allocate around 70% of his investable amount in Equity, 20% in precious metals, and the rest in Fixed income investments.

Alongside the same rationale, a retired person could invest 80 percent of his saving in fixed income, 10 percent in equity markets and a 10 percent in precious metals. The ratio in which one

allocates investments across asset classes is dependent on the risk appetite of the investor.

What are the things, you should know before investing?

Investing is a great option, but before you venture into investments it is good to be aware of the following…

1. Risk and Return go hand in hand. Higher the risk, higher the return. Lower the risk, lower is the return.

2. Investment in fixed income is a good option if you want to protect your principal amount. It is relatively less risky. However, you have the risk of losing money when you adjust the return for inflation. Example – A fixed deposit which gives you 9% when the inflation is 10% means you are net losing 1% per annum. Fixed income investment is best suited for ultra risk averse investors.

3. Investment in Equities is a great option. It is known to beat the inflation over long period of times. Historically equity investment has generated returns close to 14-15%. However, equity investments can be risky.

4.Real Estate investment requires a large outlay of cash and cannot be done with smaller amounts. Liquidity is another issue with real estate investment – you cannot buy or sell whenever you want. You always have to wait for the right time and the right buyer or seller to transact with you.

5. Gold and silver are known to be a relatively safer but the historical return on such investment has not been very encouraging.

What you learned from this article.

1. Invest to secure your future

2. The corpus that you intend to build at the end of the defined period is sensitive to the rate of return the investment generates. A small variation to rate can have a big impact on the corpus.

3. Choose an instrument that best suits your risk and return appetite

4. Equity should be a part of your investment if you want to beat the inflation in the long run.

Before you invest, it’s crucial to do your research, understand your risk tolerance, and develop a clear investment strategy aligned with your goals. You may also want to consult with a financial advisor for personalized guidance.

Read Share Market Part 3 here- Regulators of Share Market (Share Market Part- 3)