Why Should You Invest? (Share Market Part- 1)

There are many reasons why someone might choose to invest, and the best reasons for you will depend on your individual circumstances and goals. Here are some of the most common reasons people invest but before we answer the above question, let us understand what would happen if one chose not to invest. Let us assume you earn Rs.60,000/- per month and you spend Rs.35,000/- towards your cost of living which includes housing (Mortgage or Rent), food, transport, shopping, medical etc. The balance of Rs.25,000/- is your monthly surplus. For the sake of simplicity, let us just ignore the effect of personal income tax in this discussion.

1. To drive the point across, let’s make few simple assumptions.

2. The employer is kind enough to give you a 10% salary hike every year.

3. The cost of living is likely to go up by 8% year on year.

4. You are 25 years old and plan to retire at 50. This leaves you with 25 more years to earn wealth.

5. You don’t intend to work after your retirement.

6. Your expenses are fixed and don’t foresee any other expense.

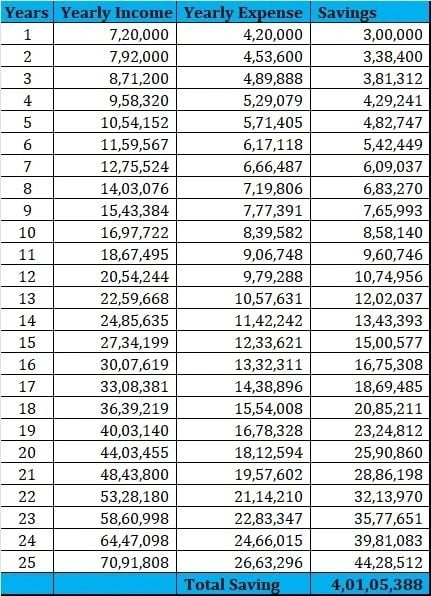

7. The balance cash of Rs.25,000/- per month is retained in the form of hard cash Going by these assumptions, here is how the cash balance will look like in 25 years as per Figure 1.

Figure 1 – Total cash balance in twenty-five years

If one were to analyze these numbers, you would soon realize this is a scary situation to be in. Few things are quite startling from the above calculations:

1. After 25 years of hard work you have accumulated Rs. 4.01 Crs.

2.Since your expenses are fixed, your lifestyle has not changed over the years, you probably even suppressed your lifelong aspirations – better home, better car, vacations etc.

3. After you retire, assuming the expenses will continue to grow at 8%, Rs. 4.01 Crs is good enough to sail you through roughly for about 10 years of post-retirement life. 11th year onwards you will be in a very tight spot with literally no savings left to back you up. What would you do after you run out of all the money in 10 years’ time? How do you fund your life? Is there a way to ensure that you collect a larger sum at the end of 25 years?

Let’s consider another scenario as per Figure 2 in the following page where instead of keeping the cash idle, you choose to invest the cash in an investment option that grows at let’s say 12% per annum.

For example – in the first year you retained Rs.300,000/- which when invested at 12% per annum for 25 years yields Rs.4,553,588/- at the end of 25th year. With the decision to invest the surplus cash, your cash balance has increased significantly. The cash balance has grown to Rs.35.35 Crs from Rs.4.01 Crs. This is a staggering 8.4x times the regular amount. This translates to you being in a much better situation to deal with your post-retirement life. Now, going back to the initial question of why invest? There are few compelling reasons for one to invest.

1. Fight Inflation: By investing one can deal better with the inevitable – growing cost of living – generally referred to as Inflation.

2. Create Wealth: By investing one can aim to have a better corpus by the end of the defined time period. In the above example the time period was up to retirement, but it can be anything – children’s education, marriage, house purchase, retirement holidays etc.

3. Grow your wealth: Over time, inflation erodes the buying power of your money. Investing allows your money to potentially grow faster than inflation, helping you maintain and increase its value over the long term. This can be crucial for achieving financial goals like retirement, a down payment on a house, or funding your children’s education.

4. Generate income: Some investments, like dividend-paying stocks or rental properties, can provide passive income that supplements your regular earnings. This can be helpful for achieving financial independence or simply improving your cash flow.

5. Meet financial goals: Investing can be a powerful tool for achieving specific financial goals, like saving for retirement, a child’s college education, or a dream vacation. By investing regularly and strategically, you can increase your chances of reaching these goals on time.

6. Diversify your assets: Investing can help you diversify your assets, which reduces your risk by spreading your money across different types of investments. This can help protect your wealth from market downturns and unforeseen circumstances.

7. Protect against inflation: As mentioned earlier, inflation erodes the buying power of your money over time. By investing in assets that historically outperform inflation, you can help protect the value of your money and ensure it will be worth more in the future.

8. Sense of accomplishment: Many people find investing to be a rewarding and engaging activity. Learning about different investment options, making informed decisions, and seeing your portfolio grow can provide a sense of accomplishment and financial empowerment.

However, it’s important to remember that investing also carries risks:

- Loss of principal: The value of your investments can go down as well as up, and there is always a chance that you could lose some or all of your invested money.

- Market volatility: Investment markets can be volatile, meaning your portfolio value can fluctuate significantly in the short term.

- Time commitment: Successful investing often requires research, planning, and ongoing monitoring.

Before you invest, it’s crucial to do your research, understand your risk tolerance, and develop a clear investment strategy aligned with your goals. You may also want to consult with a financial advisor for personalized guidance.

Read Share Market Part 2 here- Where to invest (Share Market Part 2)